35+ How much can u borrow on a mortgage

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. If you want a more accurate quote use our affordability calculator.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

It should be at or under 35 of your pre-tax household income.

. When you apply for a mortgage lenders calculate how much theyll lend. How much you can borrow really depends on how much you can comfortably afford in monthly repayments for the life of your mortgage which may be up to 35 years for owner. Switch and Save Calculator.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Enter a value between 0 and 5000000. With just a few quick questions our online mortgage calculator will give you an idea of how much you could borrow show your mortgage rates and compare.

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage. Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates and what your monthly mortgage payments could be in under. There are three parts to this calculator.

Calculate how much I can borrow. A big part of the mortgage application is your loan to value ratio or LTV. This is a percentage that shows the split between your mortgage and the loan amount after youve paid your.

While you may have heard of using. For a personal loan you may be able to borrow up to 100000 with a. This mortgage calculator will show how much you can afford.

Annual income monthly expenses and loan details. With an annual income of 50k you will be eligible for a mortgage that is worth above 100000 but below 250000. You can use an online mortgage calculator to estimate how much you might be able to borrow.

Mortgage calculator Find out how much you could borrow. How much you can borrow really depends on how much you can comfortably afford in monthly repayments for the life of your mortgage which may be up to 35 years for owner occupiers. The calculator will ask you to provide all your income streams including your.

Combined amount of income the borrowers receive before taxes and other deductions in one year. Your salary will have a big impact on the amount you can borrow for a mortgage. How much can I borrow.

A monthly payment on a 35000 loan depends on the loan repayment terms which are typically between two and five years on a loan of this size. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. For this reason our.

You can borrow up to. We calculate this based on a simple income multiple but in reality its much more complex. Evaluate your total housing payments eg.

To be able to borrow a 200k mortgage youll require an income of 61525 per year. This mortgage calculator will help you find out how much you can save by switching your mortgage to a different lender or mortgage type. A typical Buy to Let mortgage of 100000 over 20 years with 240 monthly instalments costs 64791 per month at 48 variable Annual Percentage Rate of Charge APRC 51.

Keep in mind that this is only a estimation and lenders will look at your financial. Before you invest 200k into a home youll want to be sure you can afford it. Our mortgage calculator helps by showing what.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

What S The Smallest Loan A Bank Will Give You

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

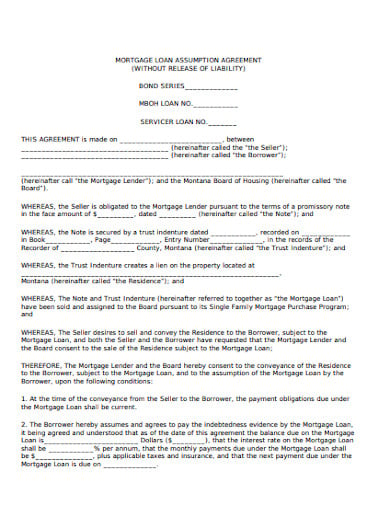

My Parents Own And Took A Home Loan On Their Name I Want To Transfer It To My Name To Avail Tax Benefits How Do I Do It Quora

Mortgage Note Sample Check More At Https Nationalgriefawarenessday Com 33628 Mortgage Note Sample

Can I Get A House Loan Without Having A Job Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Upper Income Adults Without Rainy Day Funds More Likely To Have Access To Money In Case Of Emergency Rainy Day Fund Emergency Borrow Money

11 Mortgage Agreement Templates In Pdf Doc Free Premium Templates

The Ignorance Of People 40 Today You Can T Even Have A Conversation Without Them Gaslighting You Into Thinking The Market Is Affordable For Young People R Canadahousing

Is It Just As Easy To Pay For A House In Cash And Then Get A Mortgage Afterwards Quora

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

The Bad Omen Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Can I Get A Loan Against Property The Property Is In My Mother S Name Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed