Payroll calculations for 2023

A temporary 2 reduction in the employee side of the Social Security. Payroll Software by Medlin is perfect for any small or medium sized business non-profit church or fraternal organization payroll processing and reporting.

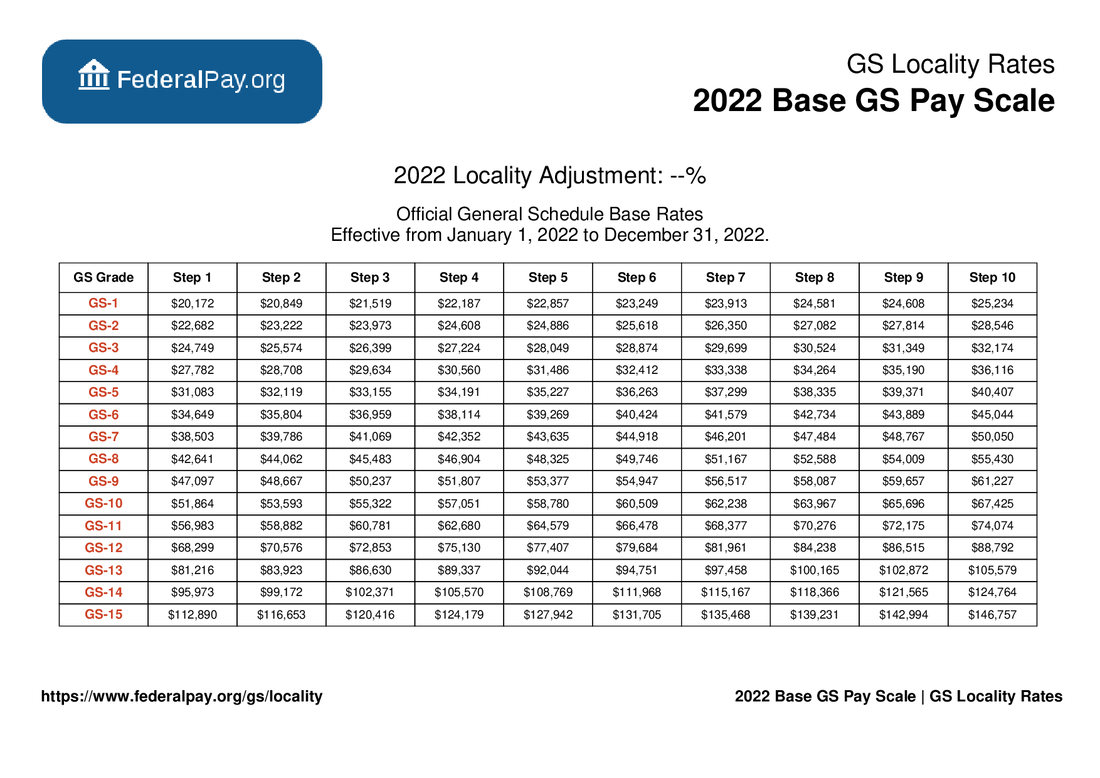

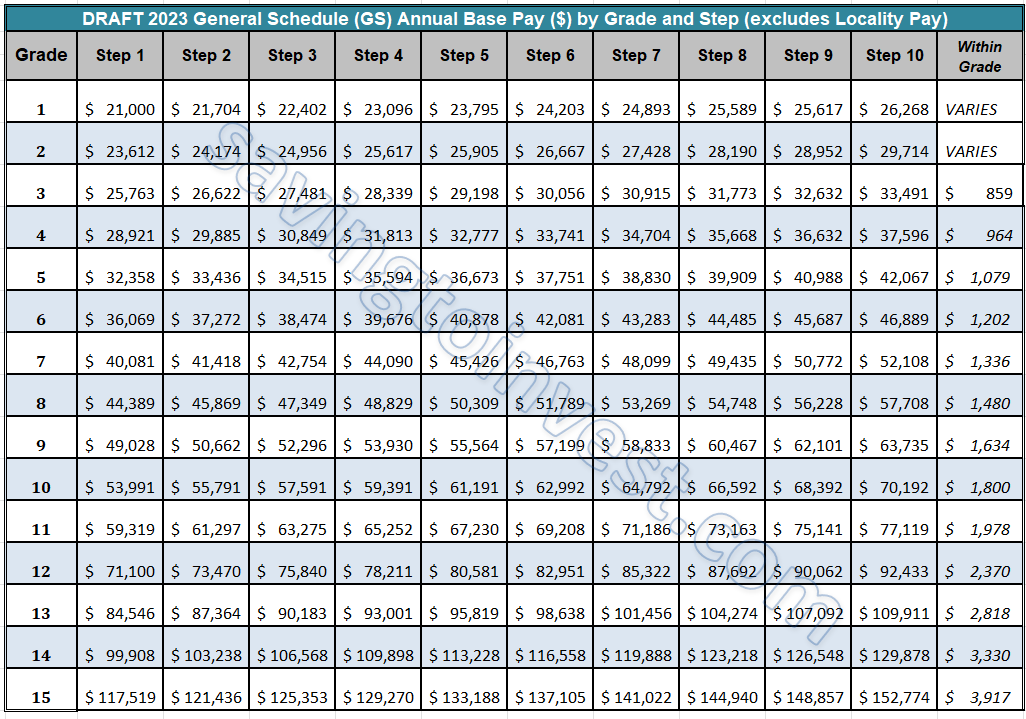

General Schedule Gs Base Pay Scale For 2022

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID.

. The general payroll tax rate in Victoria is currently since 1 July 2014 is 485 eligible regional employers 2425 progressively reducing to 12125 by 2022-23. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts. Bidens latest budget includes two major tax increases on accumulated wealth originally proposed in last years American Families Plan AFP along.

Cap Anson 1282-932 579 W-L More Franchise Info. Payroll taxes are rarely a targeted form of tax relief although it has happened in the past before the CARES Act went into effect. 11211-9929 530 W-L Playoff Appearances.

Calculations of Deductions and Net Pay. Los Angeles Dodgers Salaries and Contracts. Martin Luther King Day.

Manage payroll for up to 100 employees get all the same features in each payroll tier. Certain employers whose annual payroll tax and withholding liabilities are less than 1000 might get approval to file the annual versionForm 944. 11143-10599 513 W-L Playoff Appearances.

139 1884 to 2022 Record. The American Payroll Association is the nations leader in payroll education publications and training. The payroll tax rate reverted to 545 on 1 July 2022.

Easily check and view any historical pay runs and access payslips online for individual employees as needed. Chicago Cubs Chicago Orphans Chicago Colts Chicago White Stockings Also played as a National Association Franchise. Order now through the end of 2022 and your license includes access to 2022 and 2023 calculations and reports.

147 1876 to 2022 Record. 2022 New York Yankees MLB playroll with player contracts options and future payroll commitments. From 1 July 2017 a payroll tax rate of 365 2425 from 1 July 2018 is for businesses with a payroll of 85 regional employeesThis further.

Los Angeles Dodgers Brooklyn Dodgers Brooklyn Robins Brooklyn Superbas Brooklyn Bridegrooms Brooklyn Grooms Brooklyn Grays Brooklyn Atlantics Seasons. 100 Accurate Calculations Guarantee. Learn more about IRIS GP Payroll.

Oracle Payroll part of Oracle Cloud HCM is a fully unified solution with your HR process that enables compliant and configurable payroll across the globeno matter your industry company size or worker type. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations.

Payroll Tax Calendar 20212022 Payroll Tax Calendar 20222023 Payroll Tax Calendar 20232024. Last updated 14042022 Employment Allowance Since this. And access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

Chicago Cubs Salaries and Contracts. Discover RTI compliant processing NHS Pension Scheme pay printing more with our system. Well handle the calculations automatically.

Payroll Tax Calendar - 20212022. If youre new to payroll this course will teach you key terms and phrases and will give you an understanding of tax codes and simple income tax calculations. Payroll Calculations Proof of Employment or Income Frequently Asked Questions International Employees.

Payroll tax relief before the CARES Act. And abilities required to ensure payroll compliance. Federal Work Study Calculations.

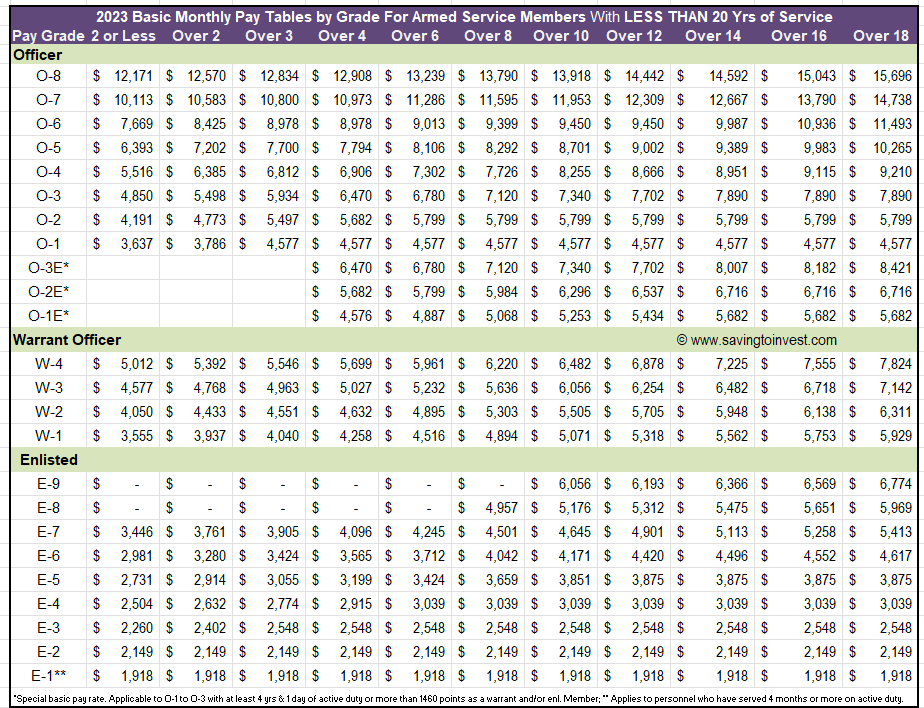

Terms and conditions may vary and. Payroll confidence starts here. The White House and Congress have proposed a 46 pay raise for the military in 2023 the largest in nearly two decades.

See the payroll dates and holiday calendar for Saint Louis University employees. Fringe Benefits and Other Payments. 2023 Fiscal Year Archived Calendars.

Becomes a free agent entering the 2023 season after the conclusion of the 2022 season. IRIS GP Payroll software simplifies managing monthly payroll. Proposed Active Duty pay raise for 2023 Proposed Reserve pay raise for 2023.

Payroll Tax Rate in Victoria. Comply with the ever-growing demands of payroll legislation and handle complex calculations. If you plan to take the FPC exam in the Fall 2022 or Spring.

All calculations provided are estimates based upon. Process your teams payroll in 3 simple steps. As part of President Bidens proposed budget for fiscal year 2023 the White House has once again endorsed a major tax increase on accumulated wealth adding up to a 61 percent tax on wealth of high-earning taxpayers.

Select Date - Location 14 Sep 2022 - Online 21 Sep 2022 - Online 28 Sep 2022 - Online. The employeragent can add or delete employees from this initial listing and must manually enter the required payroll amounts for each employee. View a full payroll tax calendar for any tax year including 20212022 - select a tax year and see all dates weeks and months for the tax year.

KU Payroll is available for in-person appointments Monday through Friday from 900 am - 300 pm. Or call us at 785-864-4385. France expected 2025 India expected 2023 Kuwait Mexico Oman expected 2023 Qatar Saudi Arabia United Arab Emirates.

This course teaches fundamental pay calculations through hands-on exercises then moves on to more complex concepts and. Ultimate zone rating calculations are provided courtesy. Utahs 2023 Withholding Guide Reflects New Threshold for.

This week Treasury Secretary Janet Yellen will testify before the Senate Finance Committee and the House Ways and Means Committee on President Bidens Fiscal Year 2023 Budget ProposalsCombined with the tax increases in the Build Back Better Act BBBA which the budget assumes becomes law President Biden would raise revenues by 4 trillion on a gross. Penalty and Interest Calculations. Payroll Software by Medlin has no monthly or per employee fees.

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

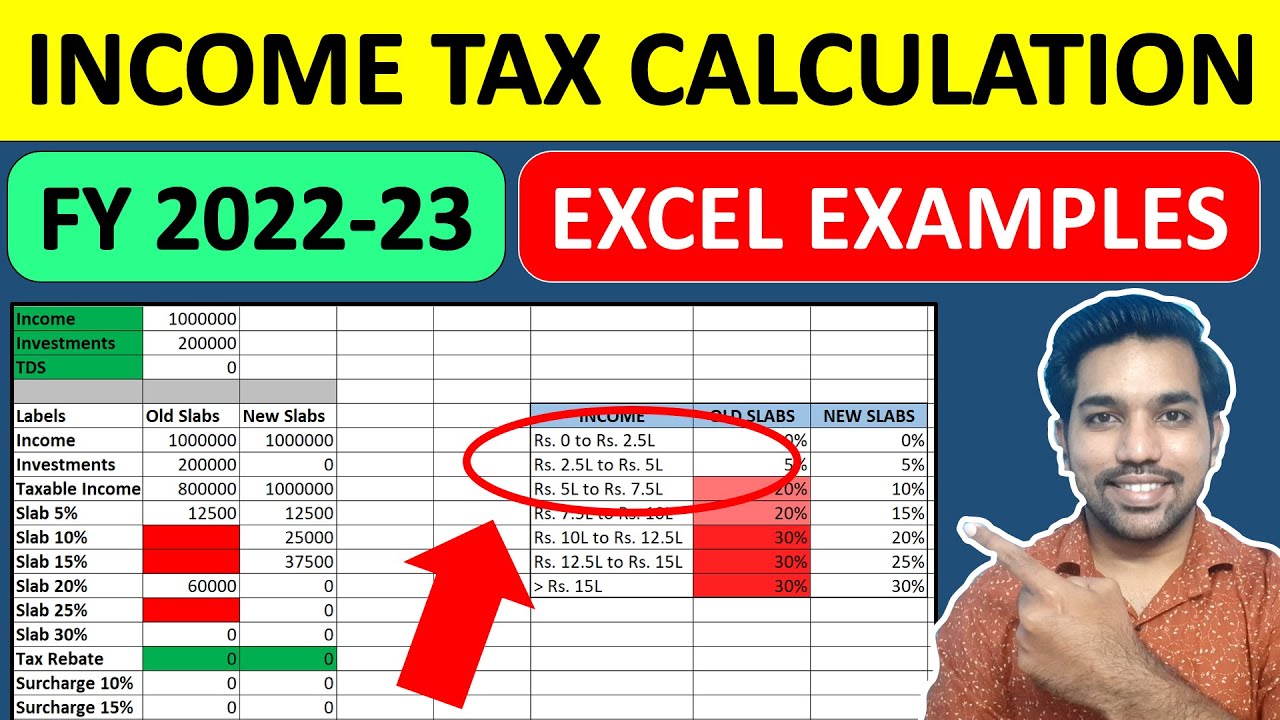

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

2023 Raise To 2022 Military Pay Charts Updated Monthly Basic Pay Tables For Armed Service Members Aving To Invest

2022 2023 Tax Brackets Rates For Each Income Level

2

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Pay Parity Calculating Your Pay Ece Voice

Payroll Calendar Chicago Teachers Union

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale

Payroll Calendar Los Angeles City Controller Ron Galperin

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2022 2023 Online Payroll Tax Deduction Calculator For 401 K 403 B Plan Withholdings

Commissioned Staff Payroll Budget For Retail Companies Example Uses

Payroll Budget Plan Excel Template Efinancialmodels